My Trade Details:

- SPLK Feb 17 2023 95 Call near $3

- Stop: Close below $85

- Target 1: $95

- Target 2: $100

SPLK – Your Bullseye Pick Of The Week - Bullseye Pick of the Week

The options were up over 300%

Here was my reasoning:

The best-looking tech stock I see right now from a risk/reward perspective is a software company that I haven’t traded in a long time – Splunk (SPLK).

After a rocky 2022, SPLK has been on the rebound after a strong earnings report in late November.

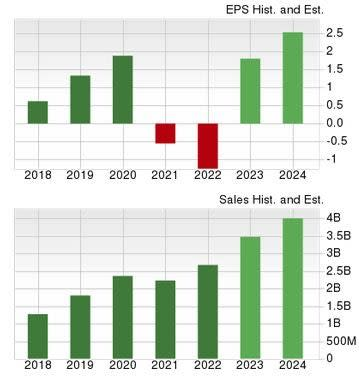

In this chart from Zack’s research, you will see that earnings are expected to rebound sharply this year and continue into 2024.

The market has been bidding up this stock on every dip since earnings, and I think it will continue.

SPLK is now within striking distance of the 200-day moving average, which is where I will put my first target near $95 if it gets there, then $100 above that for the 2nd goal.

If I am wrong, then I want to use a relatively tight stop of $85 on the stock.

You will also notice that I am aiming for options that have longer expiration than usual, and I am looking to go out of the money on this trade. That is because I might need to hold this trade longer than just a week, and I want to give myself more room.