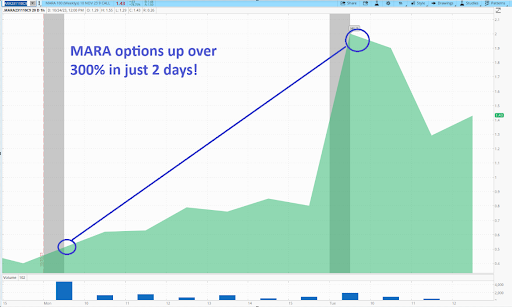

MARA – Your Bullseye Pick of the Week - Bullseye Pick of the Week

My Trade Plan Details:

- MARA Nov 10, 2023 $9 calls near $.40

- Stop: Close under $7.60

- Target 1: $9

- Target 2: $11

My Reasoning:

NVDA was great for sure, but don’t forget that the week before, I called ERX, which also made a 100%+ move.

That just reinforces my conviction that there is always a good trade out there, in any market condition, you just need to filter out the noise and focus on what is truly important.

Right now, bonds are the only thing that matter. If you are ignoring what’s going on there, you are not paying attention to the right information.

Until we see a bottom form with the bond market, interest rates will continue to soar, and do some real damage to the entire economy.

If I had a choice (and we always have a choice as traders), I would sit out this week and wait until next week to trade. This is not a great environment to trade either way. I don’t see any easy shorts this week, with things so depressed already and I also don’t see a lot of reason why the market will rally.

This is just a tough week we are walking into, plus we have to deal with a ton of earnings from some of the biggest companies in the world!

However, something that has been working lately is Bitcoin.

It is late to the party, but investors are fleeing into “safe” assets right now, and while Crypto is not what I would call a “safe” asset, I do see the reasons why people would be buying again.

There are not a lot of Bitcoin stocks I would ever think about buying, but there is one stock I think has a good chance of having an outstanding week in that sector.

My Bullseye pick this week is Mara Digital (MARA).

I will cover everything I see in the 11am LIVE SESSION so make sure you attend today.

When I look at MARA this week, I see a wedge pattern for the last few weeks. I would love to see this breakout to the upside above $8.50, and then I think it is off to the races.

We have seen MARA make some very fast, big moves when it “wakes up.” Maybe we will see that happen this week.

I will be looking to take profits around $9 on a spike, and then maybe even as high as $11 if Bitcoin can continue to rally.

If I am wrong, then I will use the recent support below $7.60 as my stop price for a loss.

I will also be setting up a higher-probability option-selling version of this trade for Alpha Hunter members today as well, so keep an eye out for that if you are a subscriber.