THE NEXT BULLSEYE TRADE DROPS IN:

[Date 00 00 00]

*I want to emphasize that I have estimated the Max profit potential of these trade plans. These do not represent my personal, realized profits (except if noted). Options trade in a huge range from opening to expiry, and exact profits and losses depend on when the trade was entered and when exited. Trading is hard, results not guaranteed and should not be expected to be replicated typically.

Oct. 16, 2023

NVDA Puts – Your Bullseye Pick of the Week - Bullseye Pick of the Week

My Trade Plan Details:

- NVDA Nov 3, 2023 $430 puts near $7

- Stop: Close above $470

- Target 1: $435

- Target 2: $420

My Reasoning:

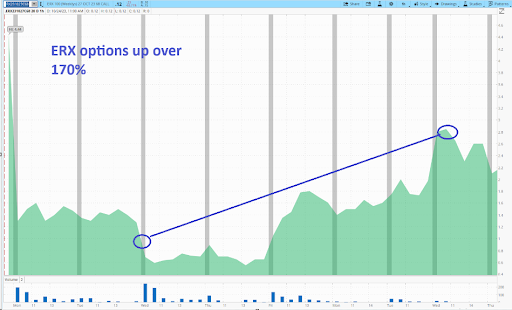

Last week was a great example with my ERX trade idea. While the market had another bad week, that trade hit my target price at the end of the week for another nice winner for anyone that decided to trade it.

This week, I am not very confident in the market and I think we will see things lower as the week goes on.

The bulls are clinging their hopes and dreams on to the coattails of AI stocks right now, and praying they will save the market.

I do not have as much faith in that trade anymore, and I think the rallies will be short-lived.

This week, I am looking to bet against the biggest player in the AI space.

My Bullseye pick this week is to short Nvidia (NVDA)

For NVDA this week, I would like to see the stock bounce higher, so I can get a better price on the puts I want to buy. That might not happen, so I plan to start with a small position sometime today, and then wait for a bounce to near $460 to add to this position.

If I am wrong on this trade, I will stop out with a closing price above $470.

If things go my way, I plan to look for a breakdown to around $435 as target #1 and then $420 as target #2 to profit.

I will also be setting up a higher-probability option-selling version of this trade for Alpha Hunter members today as well, so keep an eye out for that if you are a subscriber.

Oct. 9, 2023

ERX – Your Bullseye Pick of the Week - Bullseye Pick of the Week

My Trade Plan Details:

- ERX Oct 27, 2023 $68 calls near $1

- Stop: Close under $59

- Target 1: $68

- Target 2: $72

My Reasoning:

This week is going to be yet another difficult one. If things weren’t tough enough as we try to navigate a potential bond market collapse, we now have to deal with a pending war in the Middle East.

There are so many scenarios to consider right now, but a couple of things definitely stand out to me as winners over the next few weeks: oil stocks and defense contractors.

On the second one, I really suggest you get my previous idea on AVAV back on your radar. That stock might be ready to finally make a big move now.

For my trade of the week, however, I am looking to go with oil stocks. Instead of looking to just buy one stock, I am looking to buy a leveraged ETF of a basket of the best oil companies.

My Bullseye pick this week is (ERX).

Of course, ERX will not be an easy play this week. Nothing ever is.

The stock is already up several dollars in the pre-market today as traders are piling into oil stocks today.

My plan is to wait for the opening “panic buying” to subside and wait for any pullback during the day today. That is where I will get started with my first purchase.

If things go my way, I will get a nice smooth shot all the way to near $68, where I would lock in a profit.

If things don’t go exactly as I want, then I am looking to add to this position around $61. If things continue to fall from there, I will use a closing price under $59 as my stop loss and get out of the trade.

I will also be setting up a higher-probability option-selling version of this trade for Alpha Hunter members today as well, so keep an eye out for that if you are a subscriber.

Oct. 2, 2023

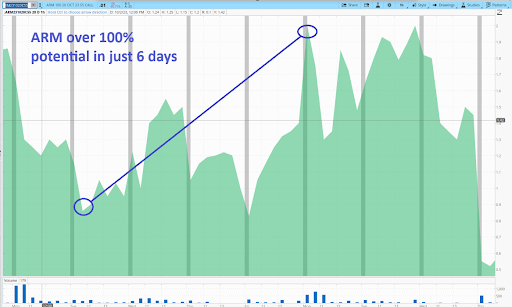

ARM – Your Bullseye Pick of the Week - Bullseye Pick of the Week

My Trade Plan Details:

- ARM Oct 20, 2023 $55 calls near $1.60

- Stop: Close under $51

- Target 1: $57

- Target 2: $60

My Reasoning:

You probably remember ARM as the biggest IPO of the year (actually, one of the only IPOs of the year) from about a month ago.

The stock was very well received, and I thought that was a great sign for the market.

ARM has a huge line of products and revenue streams. It is an excellent way to ride the growth in semiconductors.

After hitting a peak of $70 (briefly) the stock retreated to just above $50. Over the last week or so, it has been quietly moving higher and is now sitting around $53.

I think this is a perfect opportunity to see a “short squeeze” soon. I am sure a lot of traders have been betting against a further decline, but it hasn’t happened. This gradual move higher can easily spark a quick move higher, even if the market overall is sloppy.

My plan this week is to buy call options somewhere near my target price today, possibly adding more in the coming days as long as the stock stays above my $51 stop limit (closing price).

If I am correct, I think ARM can make a move above the high we saw on Friday last week, around $57 as target #1, and then if I am lucky we’ll see a breakout to $60 (or more) as target #2.

I will cover everything I see in the 11am LIVE SESSION so make sure you attend today.

Sep. 25, 2023

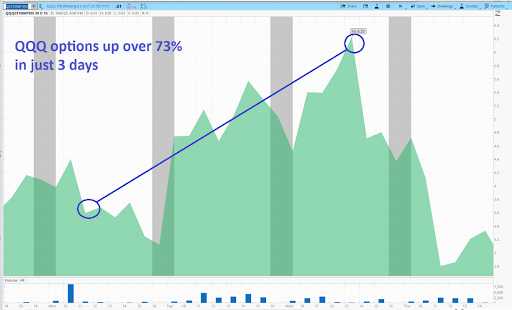

QQQ Puts – Your Bullseye Pick of the Week - Bullseye Pick of the Week

My Trade Plan Details:

- QQQ Oct 6, 2023 $355 puts near $3.60

- Stop: Close over $365

- Target 1: $352

- Target 2: $348

My Reasoning:

You can easily make an argument that QQQ is “oversold” right now. It certainly might be, but I have learned that oversold stocks can still get a lot more oversold before they rally.

My AI indicators are not close to showing a recovery yet, so I am going to stay on the bearish side of this trade.

This is not going to be an easy week for trading. The market is very volatile right now and you should expect some very large swings back and forth. If this is not your type of trading environment, I don’t think there is any shame in sitting on the sidelines and waiting for a better entry point.

I would not call this an ideal time to trade at all. That being said, I plan to attack QQQ this week in several smaller trades. I want to get started with buying puts on it this morning, and then wait for more entries.

We will see either of two scenarios: 1) QQQ will drop significantly under $355, which will be a good spot for me to take profits. 2) QQQ will dip at the open, but then rally, probably somewhere near the $362 level. That is where I plan to add to my puts.

Since I expect such a wide range of prices, I am going to keep the size small on the trade and look for a quick exit if I am right, and also let myself take advantage of any “fake rallies” that may occur.

If I am totally wrong on this trade, I think QQQ will close over $365. That will be where I stop out of this trade.

If I am right, QQQ will break under $355, and I hope to sell somewhere above $350 for a quick score.

Get ready for a fast-moving week of trading. There will be a lot of opportunities on both the long and short side of things!

I will cover everything I see in the 11am LIVE SESSION so make sure you attend today.

Sep. 18, 2023

AVAV – Your Bullseye Pick of the Week - Bullseye Pick of the Week

My Trade Plan Details:

- AVAV Oct 20, 2023 $115 calls near $1.80

- Stop: Close under $108

- Target 1: $118

- Target 2: $124

My Reasoning:

AVAV is my favorite aerospace/defense stock. I love the future potential for drones in many capacities, and this stock is the true leader. Besides being a “best in class” stock, it is so unique that I feel it would be an excellent take over target at some point. There are many bigger competitors who would love to buy future growth like we have with AVAV.

I am still very nervous about the markets here, so “hiding” in strong stocks like AVAV makes sense to me. They can outperform when markets go up, and they will (hopefully) hold their ground better that others when things go downhill.

My plan for AVAV is to grab a position sometime today, hopefully around my target entry price, though you never know exactly what the market will give you.

I am going to keep a pretty tight stop on this trade with a closing price under $108.

If things go my way, I will be looking for an exit around $118, which is just under the recent high following their earnings report. After that, I think we could see this hit $124 or more.

It is going to be a fun week of trading…I hope you are ready for it!

Sep. 11, 2023

ROKU – Your Bullseye Pick of the Week - Bullseye Pick of the Week

ROKU – Your Bullseye Pick of the Week

My Trade Plan Details:

- ROKU Sept 29, 2023 $88 calls near $2.50

- Stop: Close under $81

- Target 1: $90

- Target 2: $94

[Max potential win 60: %]

Sep. 5, 2023

GDX Puts – Your Bullseye Pick of the Week - Bullseye Pick of the Week

My Trade Plan Details:

- GDX Sept 15, 2023 $29 PUTS near $.45

- Stop: Close above $30

- Target 1: $28

- Target 2: $27

BONUS Put Spread Idea:

GDX Sept 22 BUY $30 put & SELL $28 put for $.90 net debit.

My Reasoning:

This week, I am on the fence about market direction. With $VIX trading so low, bonds not holding their recent bounce and the QQQ’s having trouble with new highs, my gut says we are headed lower this week.

That said, I think interest rate-sensitive stocks like tech, homebuilders, and miners are the most likely to fall. I find it hard to believe those will rally, unless bonds suddenly recover.

Of those sectors, I think gold stocks are showing the most weakness already and that is what I am looking to bet against this week.

My plan for GDX this week is to get started on a partial position sometime today, hopefully on a slight bounce higher (this would make the puts go lower.)

Then I’d like to add to the trade 1-2 days later, assuming GDX is still under my stop price of $30.

If things go my way, I think we will see GDX fall to under $28, which is my first target, and then we could see $27 or lower after that.

I am only looking for a small move lower on GDX, so I am going with options that expire in less than 2 weeks in order to capitalize on that. This creates more risk for the trade, but it also could have more upside for me if it works out.

It is going to be a fun week of trading…I hope you are ready for it!

Aug. 28, 2023

LLY – Your Bullseye Pick of the Week - Bullseye Pick of the Week

My Trade Plan Details:

- LLY Sept 15, 2023 $565 call near $5.50

- Stop: Close under $545

- Target 1: $575

- Target 2: $590

BONUS Call Spread Idea:

LLY Sept 15 BUY $555 call & SELL $575 call for $7.00 net debit.

My Reasoning:

While I do think the tech sector is going to stage a strong recovery, at least for a few days, I am going with one of the strongest stocks in the entire market right now.

If you haven’t been following this story, you might think it is some “AI-powered tech stock” if you simply looked at the chart. But no, it is a “boring” old pharma stock that just happens to be one of the few companies managing fantastic growth in that sector right now.

My Bullseye pick this week is Eli Lilly (LLY).

LLY is a very extended stock, but it hasn’t shown any signs of letting up yet. I think it might just keep powering higher from here if the markets hold up.

My plan is to start a position today, hopefully on a slight pullback for the stock, with a half-sized position. I want to leave room for an addition if the stock has a slight pullback this week, but stays above my stop-loss price.

If things don’t go my way, I plan to stop out of this trade if LLY closes under $545, which is the recent support level from the last week or so.

If it breaks out higher, I think we could see a meaningful move up to around $575 as my first target and even $590 after that.

It is going to be a fun week of trading…I hope you are ready for it!

Aug. 21, 2023

QQQ – Your Bullseye Pick of the Week - Bullseye Pick of the Week

My Trade Plan Details:

- QQQ Sept 1, 2023 $365 call near $3.80

- Stop: Close under $356

- Target 1: $365

- Target 2: $370

BONUS Call Spread Idea:

QQQ Sept 8 sell $360 call & buy $370 call for $4.50 net debit.

My Reasoning:

Instead of going after any individual stock, I am going to go after the tech index, and buy QQQ calls as my Bullseye pick this week.

My plan for QQQ this week is to start with a half-sized position near the market open. I would then like to add to this if QQQ gets back to $358 level.

Remember, we have a couple of significant events this week. The first is NVDA earnings on Wednesday evening. I really want to be out of at least half of my trade prior to that earnings announcement.

The other is Powell talking in Jackson Hole on Friday this week. I expect him to try and calm the bond markets, which should also benefit the stock market.

I really think we have a great 3-day window on QQQ before NVDA on Wednesday this week, so I want to make the most of it.

If I am wrong on this trade, I will stop out if QQQ looks to close under $356 level. That is a very tight stop, but I do not want to see the lows from last week get taken out. If that happens, I will walk away with a small loss.

On the upside, I think we could see $365 in short order followed by $370, which is the upper end of the Keltner channel on an hourly basis.

It is going to be a fun week of trading…I hope you are ready for it!

Aug. 14, 2023

META – Your Bullseye Pick of the Week - Bullseye Pick of the Week

META – Your Bullseye Pick of the Week

My Trade Plan Details:

- META Sept 1, 2023 $315 call near $4.70

- Stop: Close under $295

- Target 1: $310

- Target 2: $318

[Max potential win: 50%]