Oct. 18, 2021

The Trade Plan:

- My plan for the trade is as follows: I want to start a position buying calls on a dip in ROKU below $320 (I also might start a trade higher if ROKU trades above $333 first).

- My stop on the trade is going to be if ROKU closes under $305. If that happens, I will take my loss and wait for it to once again set up above the hourly levels.

- On the upside, I think ROKU can reach near $350 which is where I would take all or most of my profits.

The Trade Details:

- Higher-risk “spicy” idea: ROKU Oct 29 2021 $335 Call near $6

- More conservative idea: ROKU Nov 5 2021 $315 Call near $18

ROKU, Inc. (ROKU) - Bullseye Pick of the Week

Original Alert went out on October 18, 2021.

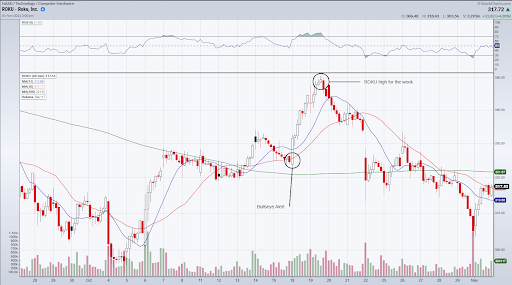

ROKU has been a very hard stock to trade to the long-side lately as it has dropped from a high in the $480’s in late July to a new low of $300 in early October. If you follow my trading, you will know that I love to buy huge previous winners (like ROKU) after they dip, the question is always “when do you step in”?

I like to target both the weekly and daily charts for clues on when that is a good idea. Right now, we are seeing ROKU begin to trade above the daily support levels I look at and the weekly chart is starting to emerge from the 4-week base as well.

| Symbol | Trade | Date | Bullseye Alert Price | Maximum Potential Yield | Position | Results |

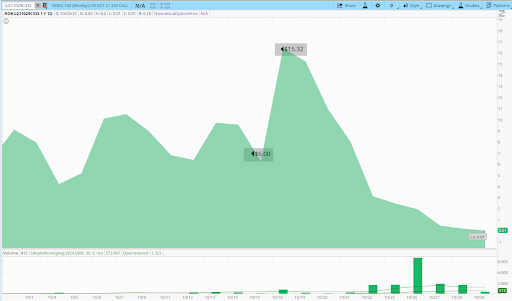

| ROKU | Spicy | Oct 15 | $6 | $15.32 | Oct 29 335 strike call | 255% |

| ROKU | More conservative | Oct 15 | $18 | $34.92 | Nov 5 315 strike call | 194% |

The Bullseye alert of the week was ROKU. The stock traded higher the following day and hit a high of just under $350 a share.

Oct. 15, 2021

The Trade Plan:

- I really like the recent “flagpole” we saw Sept 10th, which shot the stock up 12% in a single day. Since then, FIZZ has consolidated very nicely for an entire month in the low-$50 range and is finally breaking out of the $54 level which was resistance the whole time. I am looking for a slight pullback to the low $53 level, which is where I want to start a trade.

- I plan to keep a pretty tight stop on this trade. If FIZZ closes under $51, I will stop out of my position and look for another opportunity to come back to it when it sets up again later. If I am right, then I hope to take profits if FIZZ pushes up near $60.

The Trade Details:

- FIZZ Nov 19 2021 $55 Call in $2.50-3.00 range

- Another lower-risk option on this idea that I like is to sell FIZZ Nov 19 2021 $50/45 put credit spread around $1.45.

FIZZ National Beverage Co. (FIZZ) - Bullseye Pick of the Week

FIZZ was the Bullseye trade alert for the week. The stock moved above $54 dollars that week and was able to see favorable returns for just five days.

Original Alert went out on October 15, 2021.

FIZZ has been climbing higher since August even with many stocks well off their highs.

But it’s considered a tricker trade because it is a lower-volume stock and therefore has less options that are available to trade.

For example, there are no weekly contracts on FIZZ which means I’m forced into looking at a longer-term play. For this trade, I’ll be eyeballing the November contracts that have about 40 days until expiration.

Important: Due to the lower volume, I’ll be trading a smaller size position and allow for higher levels of volatility than I normally would.

Oct. 8, 2021

My Trade Plan Recap:

- My Target: I plan to scale out of half of this trade near $130, which is the recent high.

- I want to look to protect the remaining half at breakeven or shoot for $140+ if we see a surge past the all-time highs.

- My stop if we close under $107

My Trade Ideas:

- Higher-risk “spicy” idea: AFRM Oct 22 2021 120 Call near $8

- More conservative idea: AFRM Oct 22 2021 110 Call near $13

AFRM Affirm Holdings Inc. (AFRM) - Bullseye Pick of the Week

AFRM Affirm Holdings Inc. (AFRM)

Original Alert went out on October 08, 2021.

Looking at the chart above, AFRM is trading higher from its lower support level near $108. At the time of writing, this stock is being squeezed between the 13 and 30 hourly moving averages with the 100 hourly above near $115, and the 200 hourly below near $105.

AFRM has been in break mode since announcing their deal with AMZN a few weeks ago. Pouring some fuel on the fire, they announced great earnings after that. I think the recent pullback is a great entry and I am looking to load up soon.

Considering my stop first, I plan to have a stop limit on the trade if AFRM closes under $107, which is below the recent low from 2 weeks ago. The stock did not hit that level last week even though the market was the roughest we have seen in a long time.

That is a very strong sign to me. When a stock doesn’t break lower when the market collapses, that is a great signal that buyers want to step in. We have seen an “inside week” and also 2 “inside days” for AFRM in the market turbulence, which are also very strong signals.

Also consider that we have the Christmas season coming up soon and I expect that many retailers will be adapting AFRM on their checkout pages.

I believe that this should provide a lot of support as we head into December.

On the upside, I plan to scale out of half of this trade near $130, which is the recent high. After that, I would either protect the remaining half at breakeven or shoot for $140+ if we see a surge past the all-time highs.

| Symbol | Trade | Date | Bullseye Alert Price | Maximum Potential Yield | Position | Results |

| AFRM | Spicy | Oct 08 | $18.00 | $37.25 | Oct 22 120 strike call | 206% |

| AFRM | More conservative | Oct 08 | $32.50 | $47.20 | Oct 22 110 strike call | 145% |

AFRM was the Bullseye trade of the week. The stock had an amazing start to October and thought the stock would run higher, reaching almost $160 for the week.