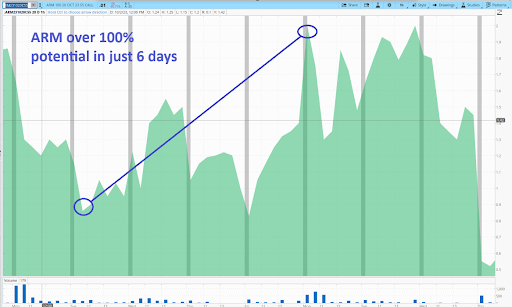

ARM – Your Bullseye Pick of the Week - Bullseye Pick of the Week

My Trade Plan Details:

- ARM Oct 20, 2023 $55 calls near $1.60

- Stop: Close under $51

- Target 1: $57

- Target 2: $60

My Reasoning:

You probably remember ARM as the biggest IPO of the year (actually, one of the only IPOs of the year) from about a month ago.

The stock was very well received, and I thought that was a great sign for the market.

ARM has a huge line of products and revenue streams. It is an excellent way to ride the growth in semiconductors.

After hitting a peak of $70 (briefly) the stock retreated to just above $50. Over the last week or so, it has been quietly moving higher and is now sitting around $53.

I think this is a perfect opportunity to see a “short squeeze” soon. I am sure a lot of traders have been betting against a further decline, but it hasn’t happened. This gradual move higher can easily spark a quick move higher, even if the market overall is sloppy.

My plan this week is to buy call options somewhere near my target price today, possibly adding more in the coming days as long as the stock stays above my $51 stop limit (closing price).

If I am correct, I think ARM can make a move above the high we saw on Friday last week, around $57 as target #1, and then if I am lucky we’ll see a breakout to $60 (or more) as target #2.

I will cover everything I see in the 11am LIVE SESSION so make sure you attend today.